missouri gas tax increase 2021

The first of five annual gas tax increases of 25 cents per gallon takes effect reaching a total increase of 125 cents by 2025. Forms posted on the Missouri Department of ite will reflect the new rate and can be found at.

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Starting Friday Oct.

. Missouris fuel tax rate is 17 cents a gallon through September 30 2021 for all motor fuel including gasoline diesel kerosene gasohol ethanol blended with gasoline biodiesel B100 blended with clear diesel fuel etc. For on road purposes. Use this form to file a refund claim for the Missouri motor fuel tax increase paid beginning October 1 2021 through June 30 2022 for motor fuel used.

The measure will gradually raise the states 17-cents-per-gallon gas tax by 125 cents over the next five years. Missouris first motor fuel tax increase in more than 20 years takes effect on Oct. Fuel tax revenues are dedicated to highway uses including the Missouri State Highway Patrol.

1 drivers filling up in Missouri will pay an additional 25 cents per gallon of gas. Once fully phased in the average Missouri driver is expected to pay between 6961 and 9626 per year. By Cameron Gerber on September 30 2021.

Refund claims must be postmarked on or after July 1 but no later than September 30 following the fiscal year for which the refund. AP Missouri Gov. By Cameron Gerber on May 12 2021.

Currently Missouri has the 2 nd lowest fuel tax in the nation and has an annual shortfall of 825 million in unfunded transportation needs. Missouri has one of the lowest gas tax rates in. The bill raises Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct.

1 but Missourians seeking to keep that money in their pockets can apply for a rebate program. The tax is set to increase by the same amount yearly between 2021 and 2025. The legislation includes a rebate process where drivers could get a refund if they save their gas receipts and submit them to the state.

Missouris current tax is 17 cents per gallon on all motor fuels including gasoline diesel and. The proposal SB 262 would increase Missouris fuel tax by 25 cents annually bumping it up to 295 cents. Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning October 1 2021 through June 30 2022 for motor fuel used for on road purposes.

When the debate focused on the impact of the fuel tax supporters talked of the safety improvements the money will buy for highways. The state will incrementally increase the gas tax by 25 cents annually with the funds earmarked for road and bridge repairs. After more than four hours on the floor the Missouri House truly agreed to and finally passed a proposed gas tax increase late Tuesday a victory for Senate President Pro Tem Dave Schatz.

Motorists across Missouri will start seeing higher gas prices Friday. The tax is passed on to the ultimate consumer purchasing fuel at retail. The tax will go up 25 cents a.

Missouri receives fuel tax on gallons of motor fuel gasoline diesel fuel kerosene and blended fuel from licensed suppliers on a monthly basis. Over the past 10 years 7 of 8 border states have increased their gas tax to improve roads and bridges. 1 until the tax hits 295 cents per gallon in July 2025.

The taxpayer will multiply 15265 by 0195 15265 x 0195. Read our blog to find out. A taxpayer purchases 15365 gallons of gasoline on October 25 2021 for off road usage.

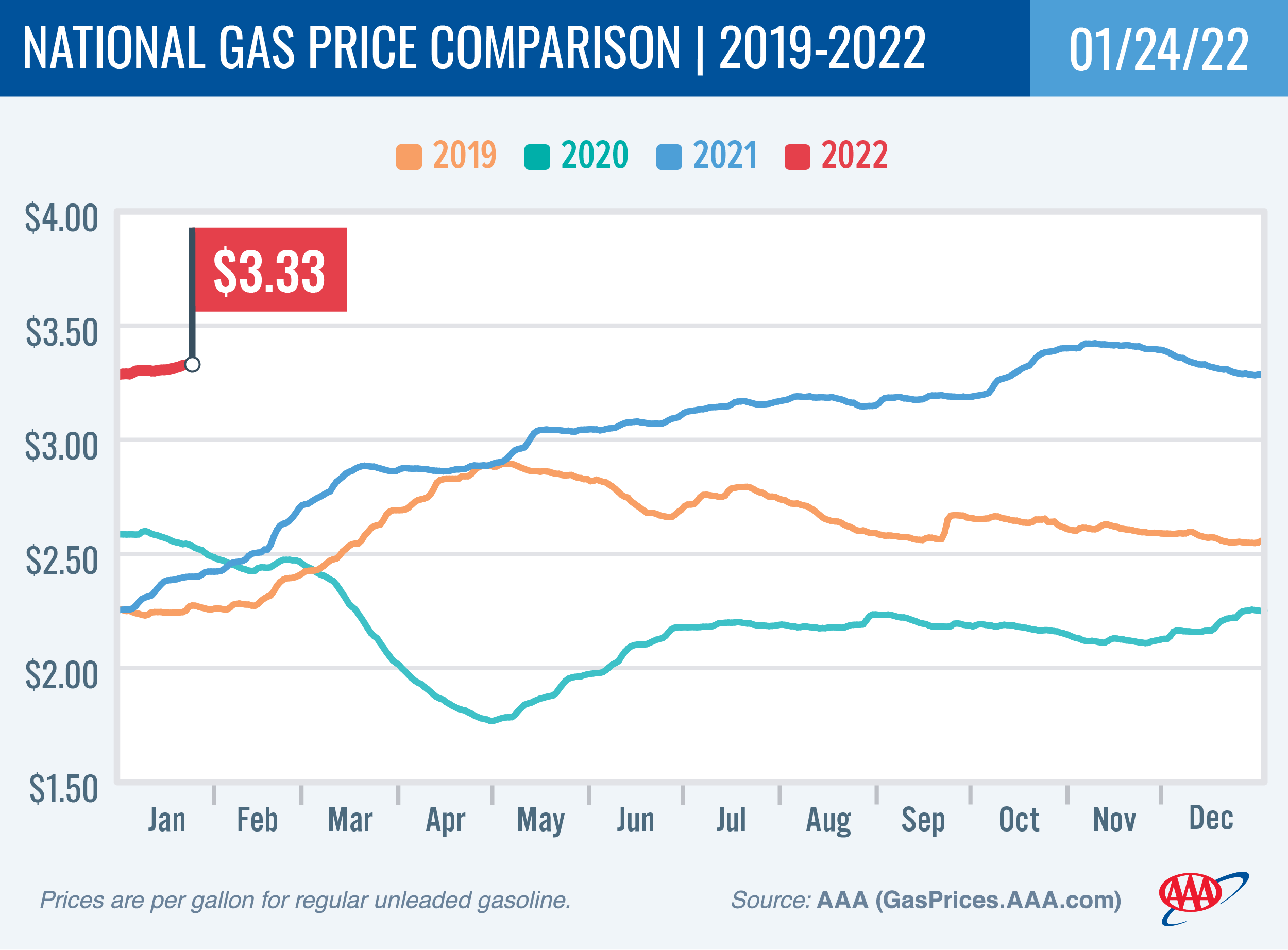

Beginning in October 2021 when the new law kicks in an additional 25 cents per gallon tax on motor fuel in Missouri will be collected. The tax rate increases an additional 25 cents per. To pass the tax increase in May 2021 when prices stood at about 275 per gallon.

The motor fuel tax rate for this time period is 0195 per gallon. Mike Parson has signed into law the states first gasoline tax increase in decades. However it may have been a long time coming.

The tax will increase an additional 25 cents per gallon in each fiscal year until reaching an additional 125 cents per gallon on July 1 2025. How Much Is the Tax Increase. At 17 cents a gallon Missouris gas tax is the second-lowest in the nation.

Missouri taxes are increasing as consumers continue to face pressure at the gas pump with average retail prices at Missouri stations peaking at about 470 per gallon in June before declining slightly to close out the month according to a GasBuddy analysis. Missouri Legislature passes 125 cent gas tax increase phased in over four years - headed to Gov for signature and its done Submitted by Brent Hugh on Wed 05122021 - 500am Today the Missouri Legislature passed a 125 per gallon fuel tax increased to be phased in at the rate of 25 cents per year from 2021 to 2025. The state of Missouris roads has been a.

Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. This raise is the first gas tax increase in the state of Missouri since 1992. The Missouri Legislature has passed a proposal that would boost the states gas and diesel tax for the.

Said increase went into effect as of October 1 2021 but what does the Missouri gas tax rebate mean for you. The taxpayer has paid 298 in motor fuel tax and may request a refund of that amount using Form 4923. May 12 2021 By Alisa Nelson.

At the end of 2025 the states tax rate will sit at 295 cents per. Missouri holds one of the lowest gas tax rates in the country at just 17 cents per. By SUMMER BALLENTINE Associated Press.

The tax is distributed to the Missouri Department of Transportation Missouri cities and Missouri counties for road construction and maintenance. This will raise it to 29 cents a gallon over the next five years. It increased the tax by six cents a gallon in three two-cent steps.

MISSOURI FUEL TAX LICENSEES. With the passage of Senate Bill 262 effective 1 2021 the Missouri motor fuel tax rate will increase from 017 per gallon to 0195 per gallon.

A Second Mortgage Record Gas Prices Strain Consumers Struggling With Rising Cost Of Living Cbc News

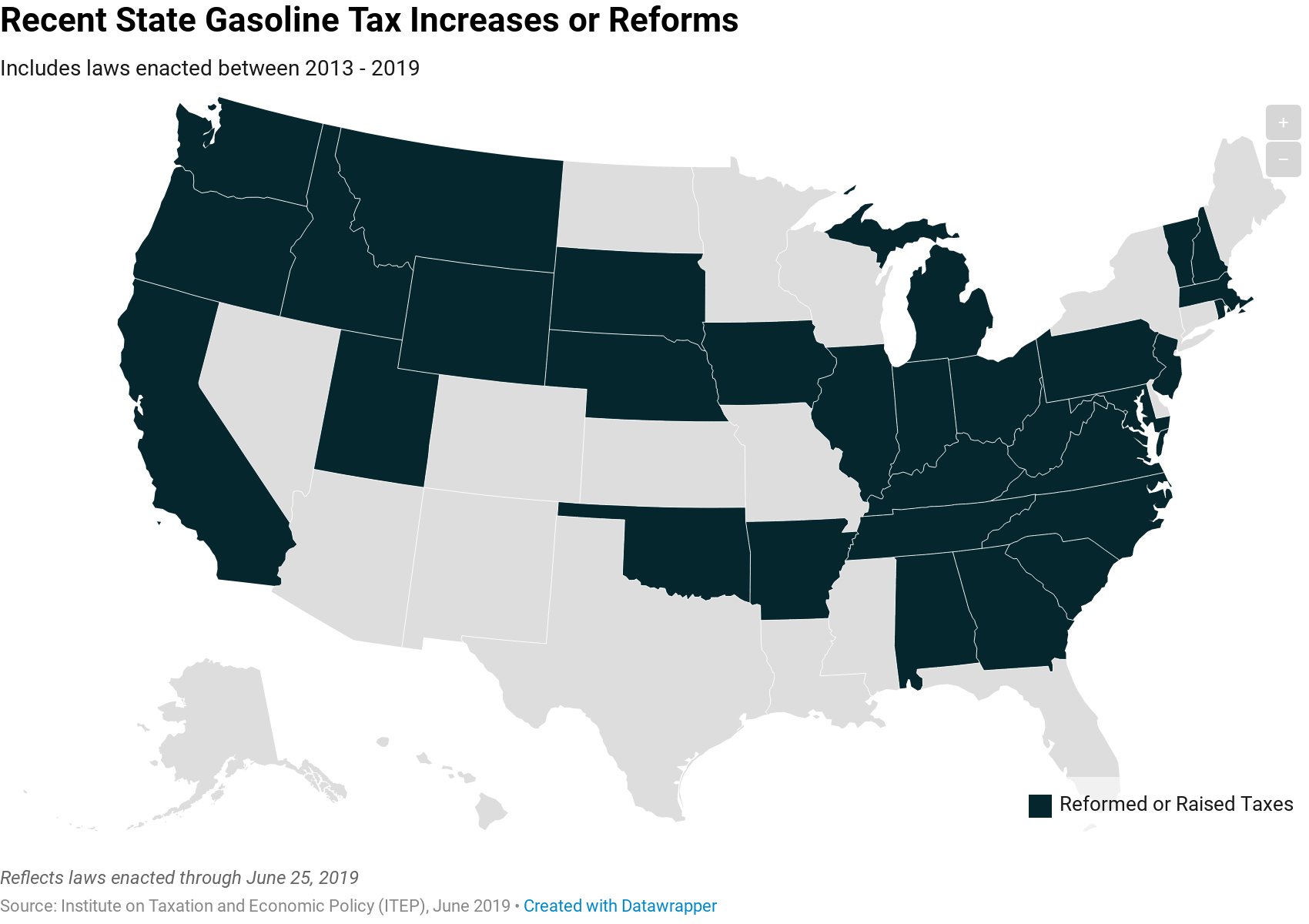

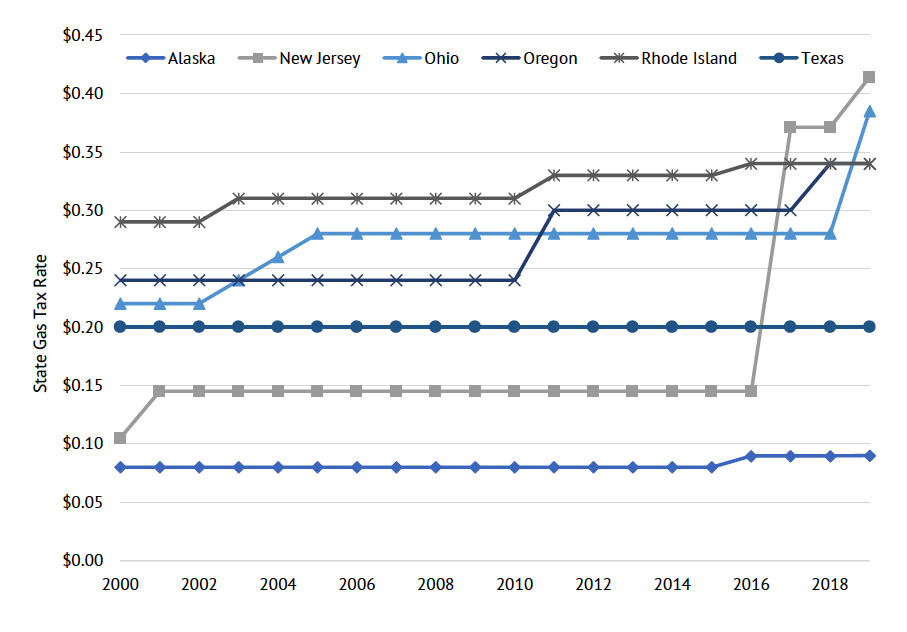

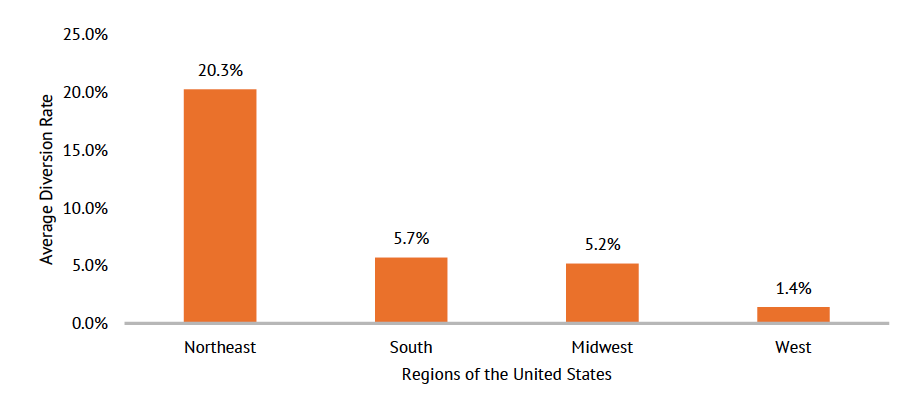

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

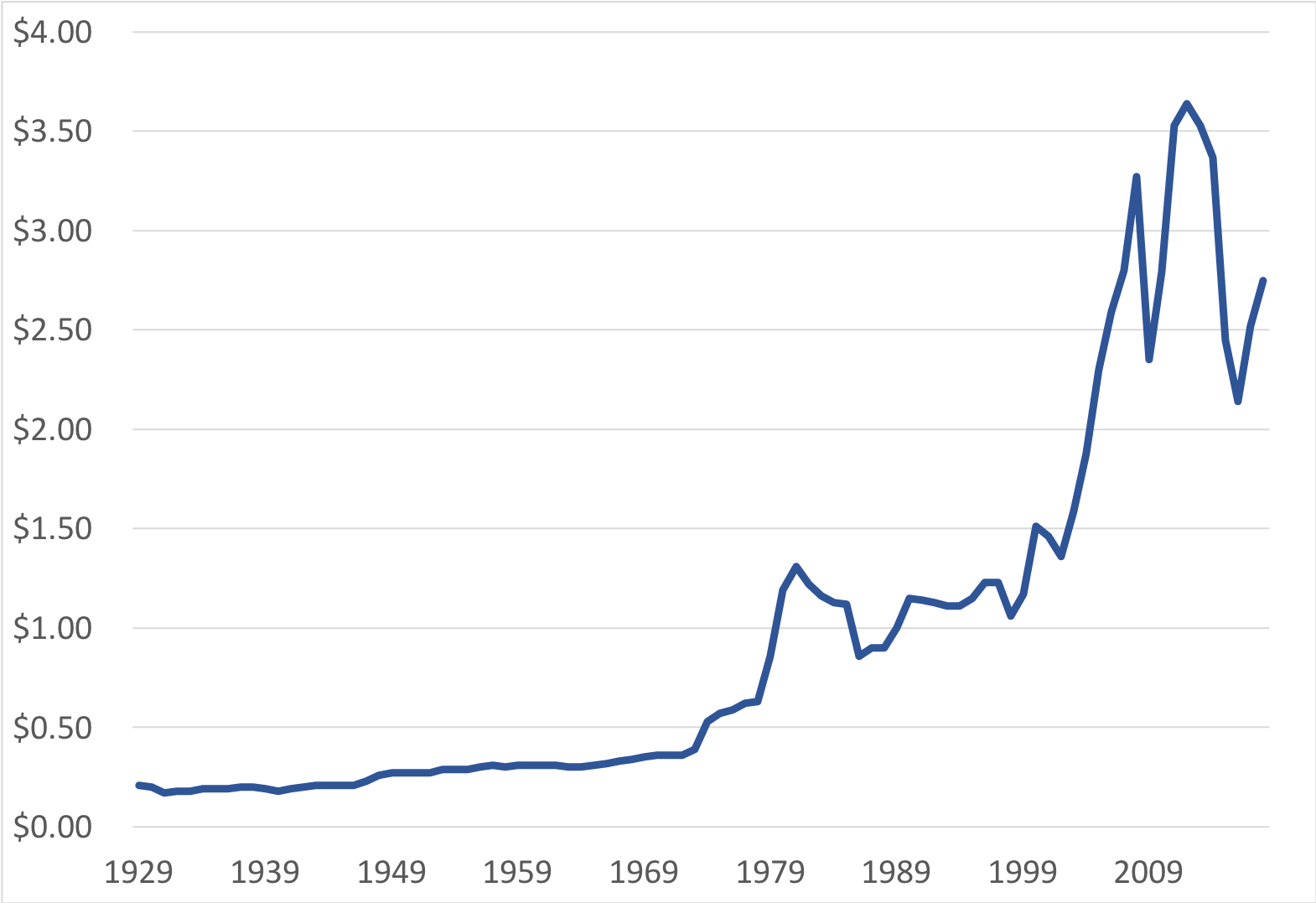

How Do We Tax Energy In The United States How Does It Compare To Other Countries

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

California Gas Tax Holiday Newsom Proposes Pause On Upcoming Increase Ktla

Gas Prices In California How Lawmakers Plan To Help Calmatters

Indiana Gas Tax Increases While State Eyes Inflation Relief Politics Bgdailynews Com

Who Controls Gas Prices In The United States How Can The Price Of Gas Go Down As Usa

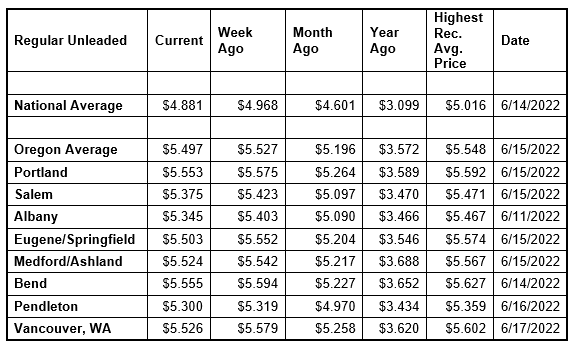

2022 Oregon Gas Price News From Aaa Oregon Idaho

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

2022 Oregon Gas Price News From Aaa Oregon Idaho

2022 Oregon Gas Price News From Aaa Oregon Idaho

A Second Mortgage Record Gas Prices Strain Consumers Struggling With Rising Cost Of Living Cbc News